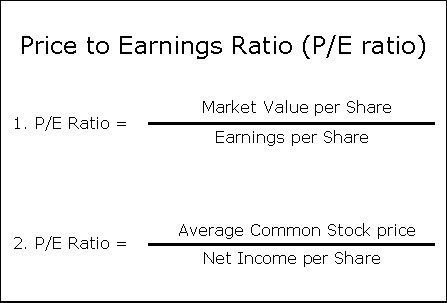

Pe ratio formula

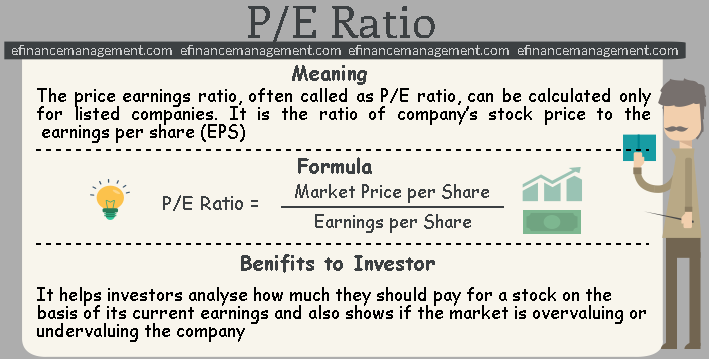

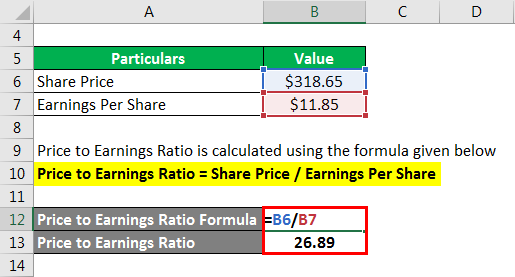

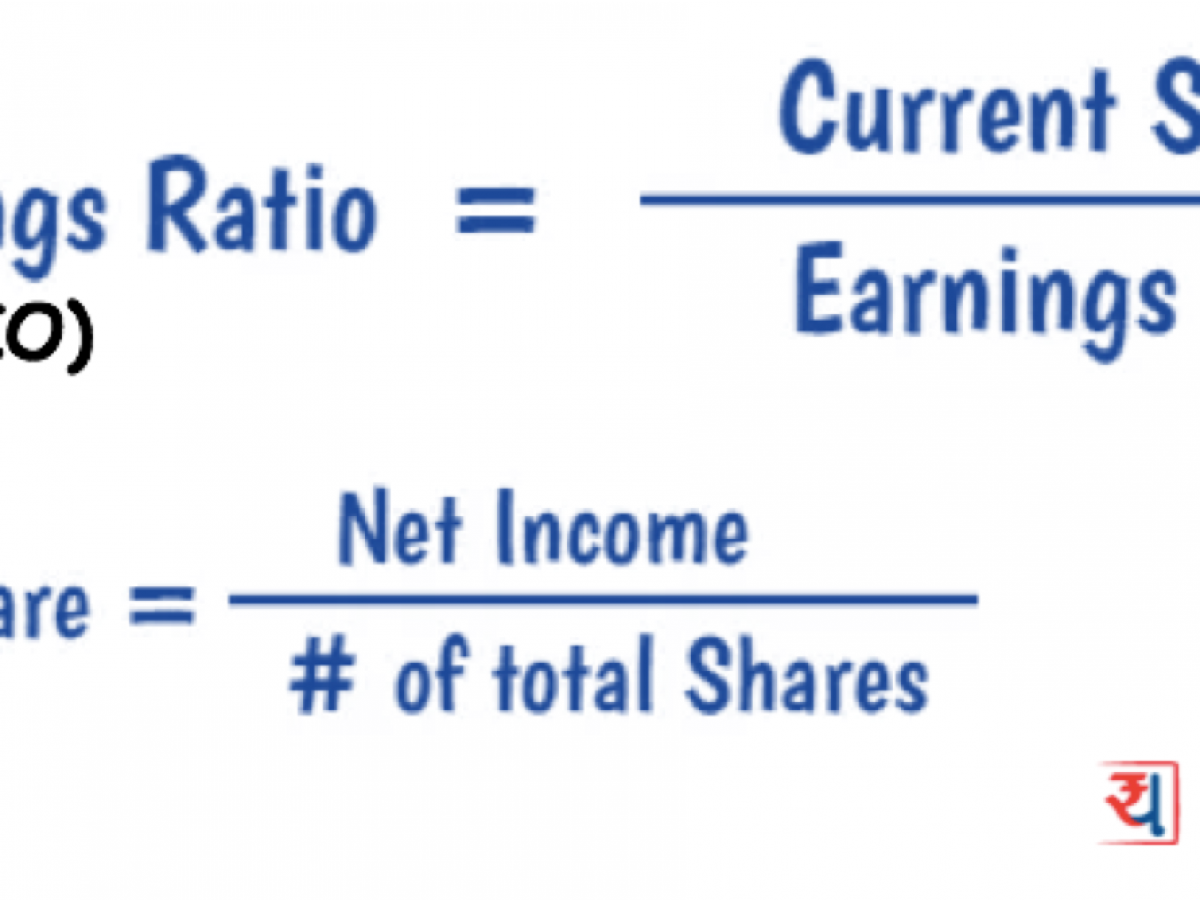

PE Ratio Market Value Per Share Earning Per Share. Please remember that there are variations of the PE ratio since the current share price can be considered an average of the last 7 days 30 days last quarter or last year depending on the time horizon.

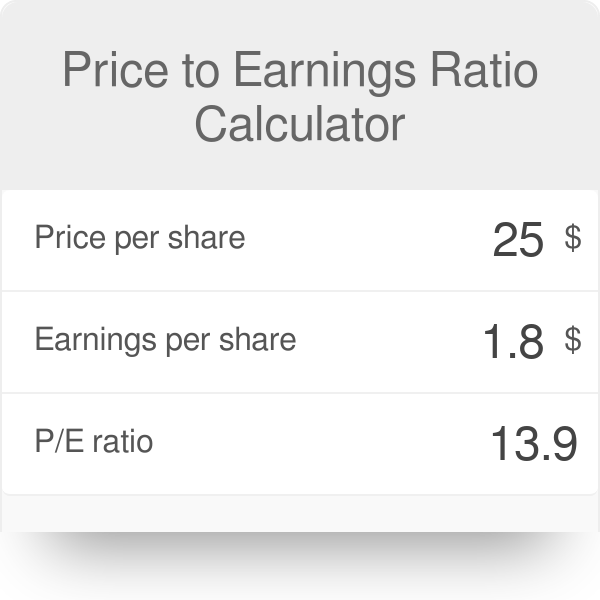

Price Earnings Ratio Calculator What Is P E Ratio

Market Capitalization Net Book Value.

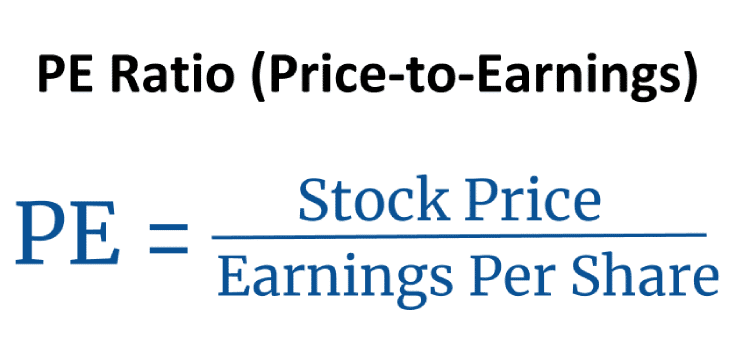

. The ratio is also shown in percentage form as follows. PE Ratio Current Market Price of a Share Earnings per Share Price to Earnings Ratio is one of the most widely-used metrics by analysts and investors across the world. The Market to Book formula is.

It is calculated as the proportion of the current price per share to the earnings per share. M is the mass of the body. It indicates ability of a profit center to control its variable costs and make.

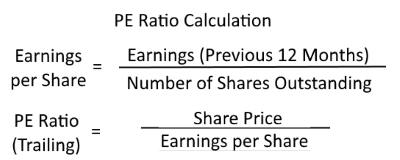

The formula for the PEG ratio is derived by dividing the stocks price-to-earnings Price-to-earnings The price to earnings PE ratio measures the relative value of the corporate stocks ie whether it is undervalued or overvalued. The PE ratio was high because earnings were depressed. Nifty 50 PE Ratio Formula Total Free Float Market Capitalisation of all 50 companies Total Free Float Profit after Tax PAT of last four quarters of all 50 companies.

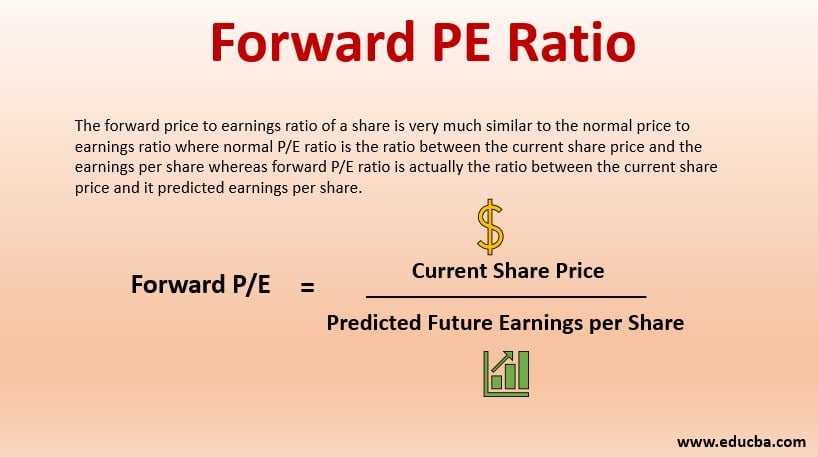

Please note that the fund manager may improve the situation and avoid writing out-of-the-money sell and buy decisions of the portfolio. The forward price-to-earnings PE ratio is a projected PE ratioThe standard PE ratio is calculated by dividing the stock price per share by the earnings from the previous year. A listed company generally has a PE ratio unless its unprofitable.

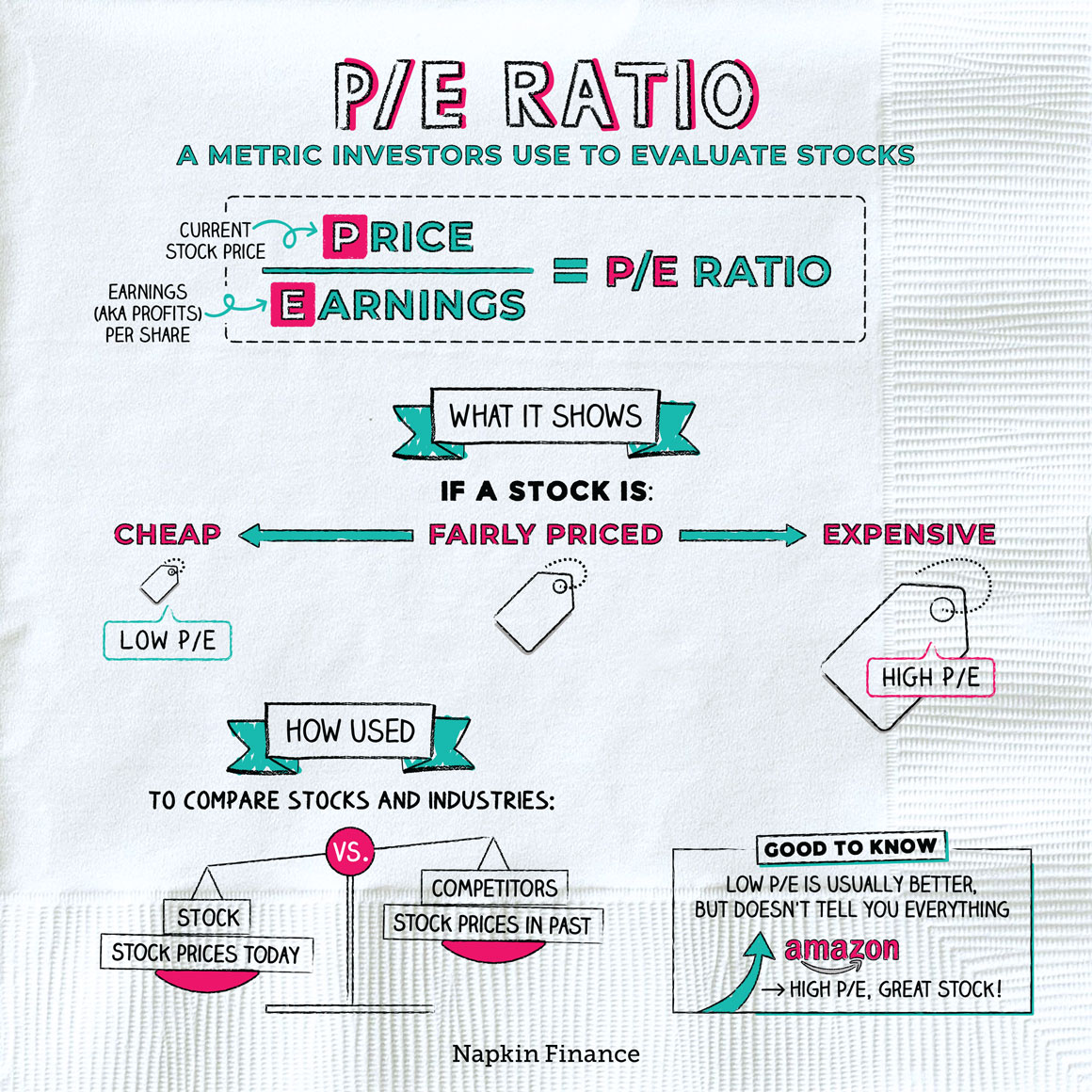

But what is a good PE ratio. The price-to-earnings ratio or PE ratio provides the ratio of earnings per share against the current market price per share. The contribution margin shows total sales revenue less variable costs of a profit center.

G is the acceleration due to gravity. U ½ kx 2. What you find above is a Nifty PE Ratio Chart which gives a complete.

The price-earnings ratio PE Ratio is the relation between a companys share price and earnings per share. Other Tools You May Find Useful. However earnings per share is sensitive to various accounting methods so it doesnt always imply that a stock is a bad investment.

The PE ratio of a high growth firm is a function of the expected extraordinary growth rate - the higher the expected growth the higher the PE ratio for a firm. The gravitational potential energy formula is. I love the simple formula of protein grams corresponding to ideal body weight over fat grams plus net carb grams.

On the other hand the Shiller PE ratio was at 133 its lowest level in decades correctly indicating a better time to buy stocks. With the PE ratio at 123 in the first quarter of 2009 much higher than the historical mean of 15 it was the best time in recent history to buy stocks. When the price of a stock is divided by the per share earnings of a company you get the PE ratio.

Market Value per Share SHP. PE ratio compares a companys stock price with its earnings per share and helps determine if the stock is fairly priced. In Illustration 181 for instance the PE ratio that was estimated to be 2875 with a growth rate of 25 will change as that expected growth rate changes.

Average number of days 365 Accounts Payable Turnover Ratio. It depends on many factors. Once its opened cover any unused formula and refrigerate it for up to 48 hours.

Ready-to-feed formula comes in 2- 6- or 8-fluid-ounce containers. These growth ratios include sales. November 2 2015.

How Does the PE Ratio Price to Earnings Ratio Work. Accounts payable turnover rates are typically calculated by measuring the average number of days that an amount due to a creditor remains unpaid. The formula for the PE ratio is PE Stock Price Earnings Per Share.

Lammeck KAJUBI PE MBA. Optimum omega fatty acids ratio Corn wheat and by-product free 100 USDA-Inspected Ingredients. Fromm Family Foods 727548 Adult Gold Large Breed Formula 15 Lb Dry Dog Food 1 Pack One Size.

Earnings per Share EPS. The formula can be written as follows. Whichever type you choose be.

Customer ratings by feature. What is PE and how is Nifty PE Ratio calculated. Price earnings ratio PE ratio is the rupee value that you are willing to pay for every rupee of earnings of a company.

Where U is the elastic potential energy. Skipping the rope faster results in a more intense workout. Accounts Payable AP Turnover Ratio Formula Calculation.

The numerator of the formula ie. Market to Book Ratio Formula. A 180-pound 816kg person jumping rope for 10 minutes at.

The PE Diet is so concise easy to understand and the exercises so well explained. It denotes what the market is willing to pay for a companys profits. The formula to calculate the PE ratio is as follows.

From April 2021 Consolidated earnings is used to calculate Nifty. H is the height at which the body is placed above the ground. It can also be shown that the PE multiple is driven by 1 gROE r g where r is the cost of equity g is the growth rate and ROE is return on equity.

The elastic potential energy formula or spring potential energy formula is. How many more calories are burned from skipping the rope faster. Dividing that average number by 365 yields the accounts payable turnover ratio.

It signifies the amount of money an investor is willing to invest in a single share of a company for Re. Love how he puts it that the PE ratio is infinitely scalable. Growth ratios are indicators of how fast our business is growing.

Made in the USA in a USDA-Inspected plant. To arrive at a company. If earnings per share EPS is lower than zero then that causes the stock to have a negative PE ratio.

The PE Ratio helps investors gauge the market value of a share compared to the companys earnings. The CAPE ratio is a valuation measure that uses real earnings per share EPS over a 10-year period to smooth out fluctuations in corporate profits that occur over different periods of. The forward PE ratio differs from the standard PE ratio in that it is not based on historical earnings.

Below the tool you can find the formula used. Moreover this includes averting situations with default risk and irregular marking to market of less liquid assets. Where PE is Potential energy.

1 of its earnings. And 20 of them being well overweight Today I am 28lbs lighter than. So the Sharpe ratio formula is R p R fs p Please note that here.

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

What Is The Pe Ratio How To Use The Formula Properly

P E Ratio Definition Formula Examples

Forward Pe Ratio A Qucik Glance Of Forward Pe Ratio With Example

Price Earnings Ratio Formula Examples And Guide To P E Ratio

P E Ratios Howthemarketworks

What Is A Price Earnings Ratio P E Ratio Formula Examples

Price Earnings Ratio Formula Examples And Guide To P E Ratio

P E Ratio Price To Earnings Formula And Calculator Excel Template

How Can I Use The Price To Earnings P E Ratio

P E Ratio Meaning Valuation Formula Calculation Analysis More

Price To Earnings Ratio Example Explanation With Excel Template

P E Ratio Price To Earnings Formula And Calculator Excel Template

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Justified P E Ratio Trailing And Forward Formula Excel Template

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube